Reducing the tax wedge: government action is needed

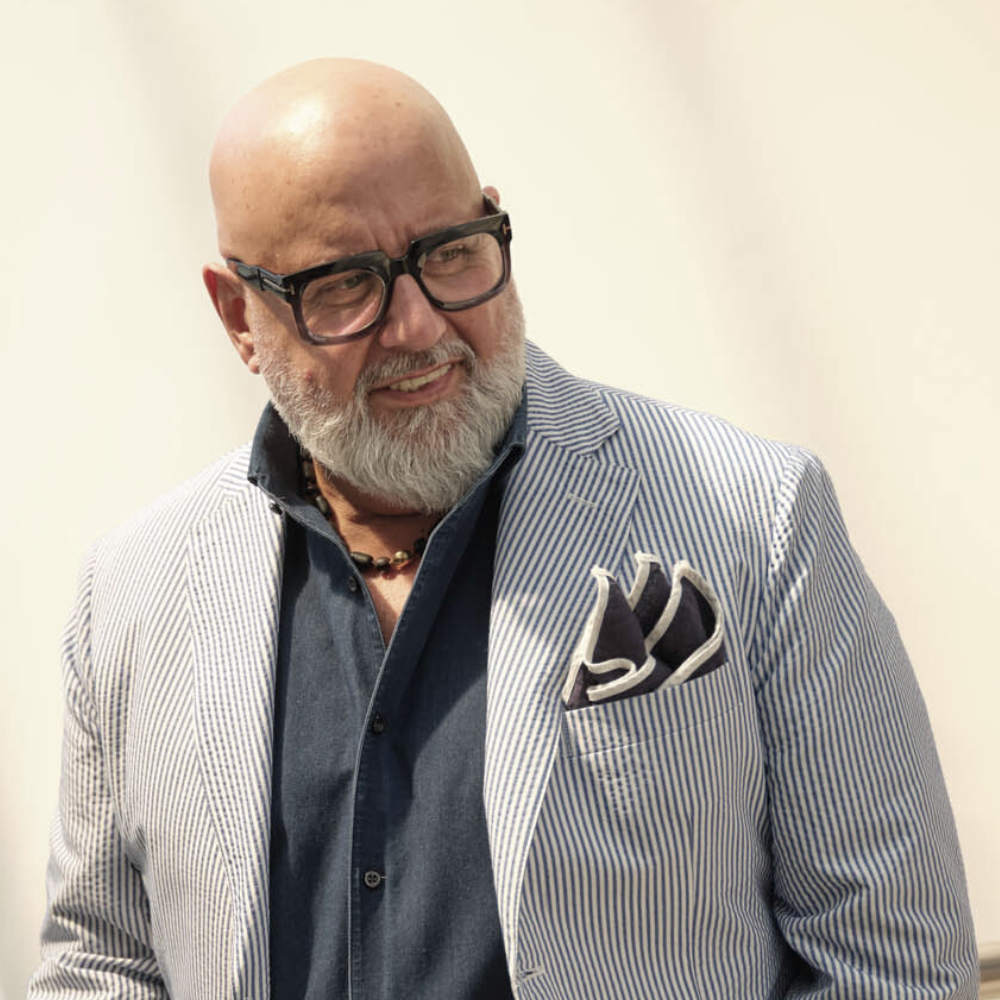

In a recent interview with La Stampa on the topic of wages, Giani stressed the importance of reducing the tax burden to enable businesses to incentivize employment and workers to regain their purchasing power.

“Magic is aiming to increase its current workforce of 90 employees to 100 within the year. The expansion is due to the planned 7-day-a-week use of our plant, which produces biodegradable and compostable cellulose non-woven fabric,” said Giani.

While an increase in salaries is certainly desirable, Giani emphasized that this must be achieved through a reduction in the tax wedge:

“In the current macroeconomic scenario, certain commitments risk being unsustainable for companies: a monthly increase of €100, for example, would result in spending €250 for the company. However, we are trying to do our best: even in 2022, a very difficult year because of increases in raw material prices, we have guaranteed production bonuses to our employees”.

Giani added that the factors that make entrepreneurs cautious are related to uncertainty and price increases. In the first 7-8 years, Magic had never raised its prices, but in the last 2 years, it has been forced to do so three times, and this has not been enough to recover from the heavy cost rises.

“If labour costs were to increase as well, we would go out of the market, throwing the accounts out of balance. As entrepreneurs we can only do so much: we invest and will continue to do so, but on a crucial issue such as the recovery of workers’ purchasing power, concrete government action is needed. Supporting the commitments made to our employees and being able to count on government intervention would be the ideal solution to guarantee the salary increases and the sustainability of business activities.”